The Full RWA Lifecycle - From Asset to Investor

The core purpose of this platform is to manage the complete lifecycle of a RWA, seamlessly connecting valuable off-chain assets with investors through tokenization. This document outlines that journey.

The Main Players

To understand the lifecycle, we must first introduce the main players in our ecosystem:

The Asset: The underlying, tangible or intangible real-world Investments(e.g., a commercial building, a portfolio of loans, or private company equity).

The Offerring: The digital "wrapper" that represents the Asset on the platform. This is the specific investment opportunity made available to investors.

The Investor: The verified individual or entity who invests in the Offerring.

The Platform Admin: The operation team, using the admin panel to facilitate and manage this entire process.

The Journey - A Step-by-Step Narrative

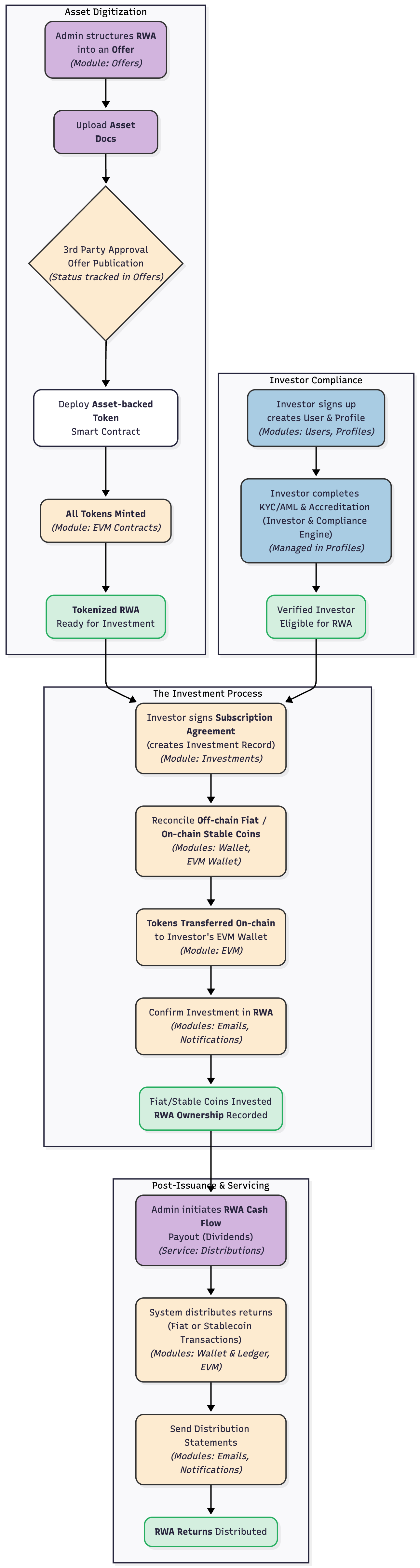

The lifecycle unfolds in four distinct phases, each managed through specific modules in the admin panel.

Phase 1: Asset Structuring & Digitization

This is where an RWA is brought onto the platform and prepared for investment.

Story: An asset manager decides to tokenize a new bond asset.

Admin Actions:

- The asset manager first creates an Offer in the admin panel, defining its financial terms.

- They upload the necessary legal documents to be saved in the platform's Filer.

- The asset manager sends the Offer for Approval handled by 3rd parties (Regulatory Verification of entity holding the asset, Electronic Wallet creation if applicable)

- A EVM Contract is configured, creating the on-chain representation of the asset (the tokens).

Outcome: A new, investable RWA is now structured and listed on the platform.

Phase 2: Investor Onboarding & Compliance

This phase ensures that every investor is legitimate and legally qualified to participate, which is crucial for building trust and maintaining regulatory adherence.

- Story: A potential investor discovers the offering and wants to participate.

- Admin Actions:

- The investor signs up, creating a User account and a corresponding Investment Profile appeared in the admin panel.

- The investor starts Regulatory Onboarding and KYC/AML& Accreditation verification. The compliance team uses the Regulatory Compliance Engine to review the profile in the admin panel , check the KYC/AML & Accreditation statuses.

- Outcome: The investor is approved and becomes eligible to invest.

Phase 3: The Investment Process

This is the capital formation phase, where a verified investor securely commits funds to the asset.

- Story: The verified investor decides to invest in the offering.

- Admin Actions:

- The investor's commitment automatically creates an investment record, linking their profile to the offer.

- Funds are received and tracked through the wallets & transactions(off-chain/on-chain) modules, creating a detailed ledger entry.

- The admin panel tracks the funding progress of the offer in real-time.

- Automated Emails and In-App Notifications and statements are sent to all investors.

- Outcome: Capital is successfully raised for the RWA.

Phase 4: Post-Issuance & Servicing

The journey doesn't end once the asset is funded. This phase covers the ongoing management and financial relationship with investors.

Story: The bond asset generates investment return, which needs to be paid out as dividends to token holders.

Admin Actions:

- The platform uses the Smart Dividends Engine to initiate a payout for the Offer.

- The system automatically calculates each investor's share and initiates Transactions to their Wallets.

- Automated Emails and In-App Notifications and statements are sent to all investors.

Outcome: Investors receive returns, and the asset is managed effectively throughout its life.

The Blueprint

This entire lifecycle can be visualized as a continuous flow. The diagram below illustrates how the core components interact.

Linking Concepts to Admin Models

This table explicitly connects each phase of the lifecycle to the primary modules you will use in the admin panel.

| Lifecycle Phase | Key Admin Models Used |

|---|---|

| 1. Asset Digitalization | Module-Offers, Module-Filer, Module-EVM-Contracts |

| 2. Investor Compliance | Module-Users, Model-Profiles, Module-EVM-Contracts |

| 3. Investment-Process | Module-Investments, Module-Wallets, Transactions, EVM-Wallet, EVM-Transfers |

| 4. Post-Issuance | Distributions, Transactions, EVM-Transfers, Module-Communication |