RWA Tokenization Platform: Functional Specification

This document outlines the core services and capabilities of the WebDevelop PRO RWA investment platform. It is designed to understand the unique features, technical strengths, and robust architecture of our solution. Each service described below is a modular component powered by our underlying business logic and data models, providing you with a flexible and powerful system to launch and manage your own tokenization platform.

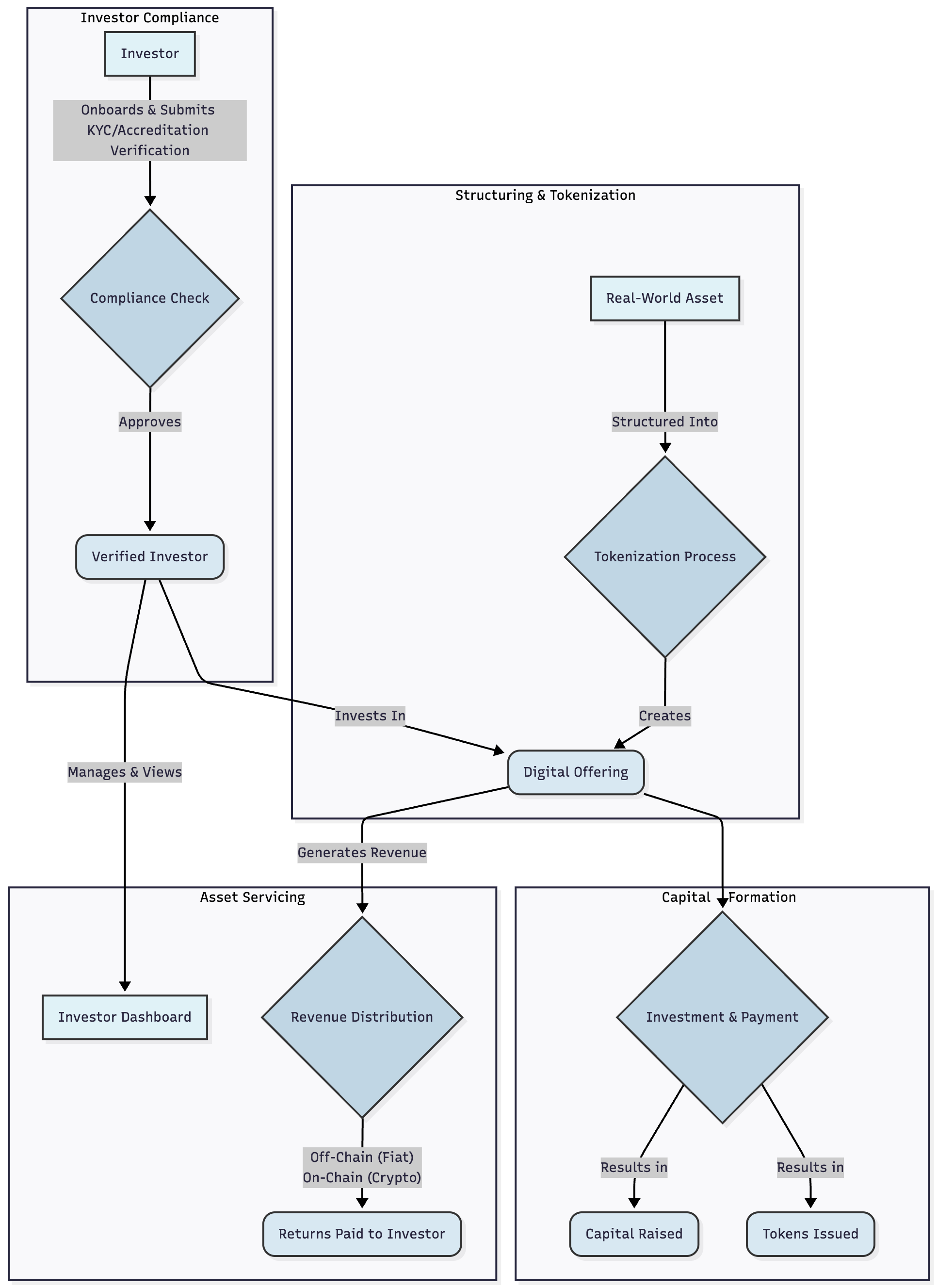

High-Level Concepts: The RWA Lifecycle

The core purpose of the WebDevelop PRO platform is to manage the complete lifecycle of a Real World Asset (RWA), seamlessly connecting valuable off-chain assets with on-chain investment through tokenization. This document outlines that end-to-end journey, illustrating how the platform's core data models and services work in concert.

The Core Entities

To understand the lifecycle, we must first identify the core data entities that represent the players in our ecosystem. These are the fundamental building blocks defined in "Data Models" part of this specification.

The Asset: The underlying real-world investment, which is represented on the platform by the offer data model.

The Investor: A verified and compliant user, represented by their profile and associated user account.

The Capital: The flow of funds, represented by investment, transaction, wallet, evm-transfer, and evm-wallet data models.

The Token: The on-chain representation of ownership, managed by a Smart Contract.

The Lifecycle Phases

The journey of an RWA on the platform unfolds in four distinct phases.

Phase 1: Asset Structuring & Digitization

This is where an RWA is onboarded and prepared for investment. The goal is to create a secure, compliant, and transparent digital representation of the asset.

Story: An asset manager decides to tokenize a new portfolio of private credit loans.

Platform Services in Action:

The RWA Tokenization Engine is used to create an offer, defining its financial terms (

valuation,security_type,capital_being_raised, etc.).The Filer Service securely ingests and manages all associated legal and due diligence documents.

The Regulatory Compliance Engine facilitates third-party checks on the asset-holding entity.

A Smart Contract is configured and linked to the offer, creating the on-chain tokens that represent ownership.

Resulting State: A new, fully structured offer is created and ready for legal approval before being published.

Phase 2: Investor Compliance

This phase ensures every investor is legitimate and qualified, building a foundation of trust and regulatory adherence.

Story: A potential investor discovers the offering and wants to participate.

Platform Services in Action:

The system creates a user account and a corresponding profile upon signup.

The Regulatory Compliance Engine orchestrates the Compliance Onboarding Questionnaire, KYC/AML, and Accreditation verification workflows, marking the profile ready for investing upon successful completion.

Resulting State: The investor's profile becomes eligible to participate in offerings.

Phase 3: Capital Formation

This is the investment phase, where the platform securely manages the flow of capital from verified investors to the asset's offering.

Story: The verified investor decides to invest in the loan portfolio.

Platform Services in Action:

The Investment Process Management service creates an investment record, linking the investor's profile to the offer.

The investor executes legal documents via the integrated Electronic Signature Service.

The Integrated Wallet Solution receives funds, creating immutable transaction and evm-transfer records and updating the investor's wallet and evm-wallet balance.

Upon successful payment confirmation, the linked Smart Contract automatically mints the corresponding asset tokens.

The system provides real-time tracking of the offer's funding progress against its goal.

Resulting State: Capital is successfully raised, and the offer status moves further to LEGALLY-CLOSED`&`CLOSED-SUCCESSFULLY. The linked Smart Contract automatically distributes the corresponding asset tokens to the investor's designated crypto |wallet.

Phase 4: Post-Issuance & Asset Servicing

This phase covers the ongoing management of the asset and the financial relationship with investors after the initial fundraise is complete.

Story: The loan portfolio generates interest income, which must be distributed to token holders.

Platform Services in Action:

The Smart Dividends Service is used to calculate and initiate a payout for the offer.

The system automatically calculates each investor's pro-rata share based on their investment.

The Integrated Wallet Solution processes fiat payouts by creating new transaction records from the offer's wallet to each investor's wallet. Alternatively, for on-chain assets, the service can airdrop stablecoins via evm-transfer as dividends directly to investors' crypto wallets.

The Communication Module sends automated statements and alerts to all investors, accessible via their Investor Portal.

Resulting State: Investors receive returns on their Investments, and the asset is managed effectively throughout its entire economic life.

The Lifecycle Diagram